Apple: Preparing For A Future-Defining WWDC (NASDAQ:AAPL) – Technologist

gece33/iStock Unreleased via Getty Images

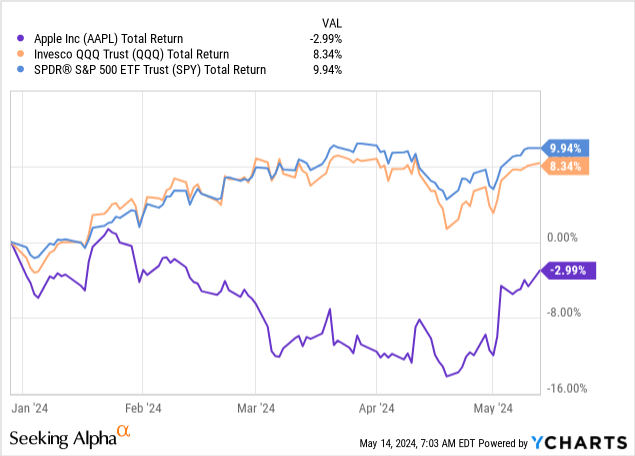

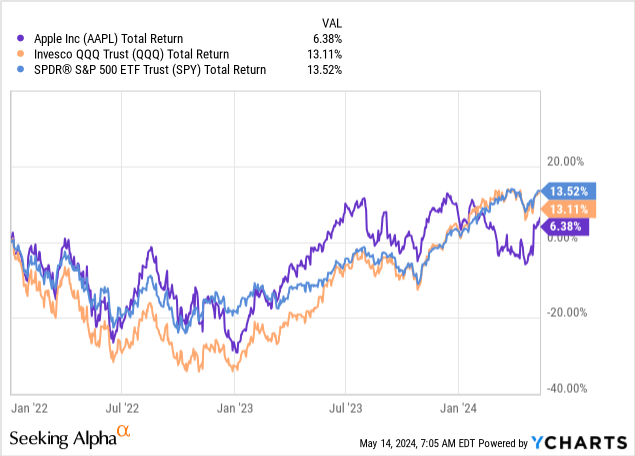

Apple (NASDAQ:AAPL) shares are flat year-to-date, trailing the rest of big tech by a significant margin. After a sharp recovery, the stock is now 6% below all-time highs.

The iPhone maker’s underperformance is justified by lackluster growth since 2021, with five out of the last six quarters showing declining revenues on a year-over-year basis, as well as several quarters of declining net income.

Apple investors have a lot to worry about, including market saturation, regulation, lack of innovation, China exposure, and the selling of shares by Warren Buffett, one of the company’s largest shareholders and strong supporters.

Despite all of that, Apple has been able to generate enough excitement about its upcoming developer’s conference and overcome these worries, as reflected by the 13% increase in the last month.

So, let’s prepare for this future-defining WWDC set to take place in June, and discuss the right way to position ourselves ahead of the big conference.

Apple’s Underperformance Is Underpinned By Fundamentals

I’ve been covering Apple on Seeking Alpha for over a year now. My first three articles were dedicated to explaining Apple’s ecosystem, its underappreciated services business, and its setup heading into 2024.

The fact that Apple has been one of the great investments in history won’t be major news to anyone, but as of recently, the company has been struggling, and so has the stock.

On a year-to-date basis, Apple is underperforming the market by more than 10%, in a year that’s generally been extremely good for the rest of big tech.

In fact, since the end of the 2021 bull market, Apple hasn’t been able to keep up with the market, as the company failed to sustain consistent growth post-pandemic.

Before discussing the future, it’s important to go over all the issues and headwinds Apple is dealing with.

The List Of Problems Is Long And It’s Growing

I discussed the reasons for Apple’s underperformance extensively in a previous article, but I think it’d be beneficial to revisit them quickly.

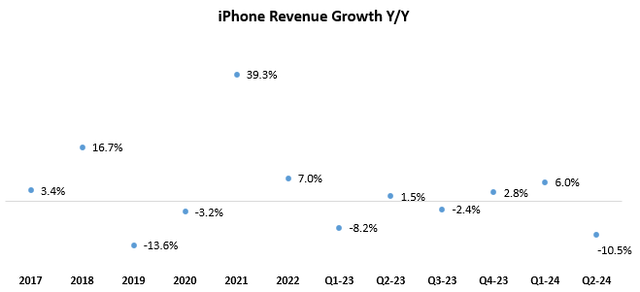

It all comes down to Apple’s results, and more specifically, revenues. Since fiscal Q1 ’23, Apple’s revenue growth, on a Y/Y basis, was as follows: -5.5%, -2.5%, -1.4%, -0.7%, 2.1%, and -4.3%. For a company that’s trading at a high-twenties multiple, these growth numbers are obviously an issue.

The lack of growth pretty much comes down to a lengthy replacement cycle. Apple still generates the majority of its revenues (more than 75%) from hardware. The quality of Apple’s hardware is a double-edged sword because a 5-year-old iPhone is still working just fine, and so are old AirPods, iPads, etc.

That, combined with the lack of material innovation from Apple’s front, has resulted in the worst replacement cycle in quite some time for the company.

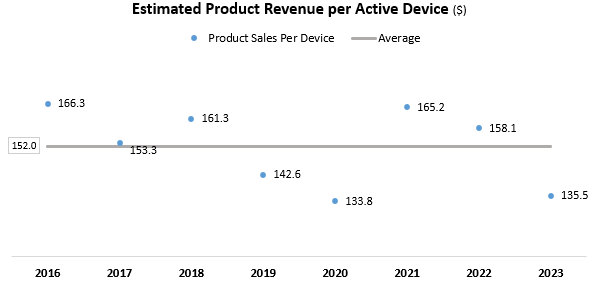

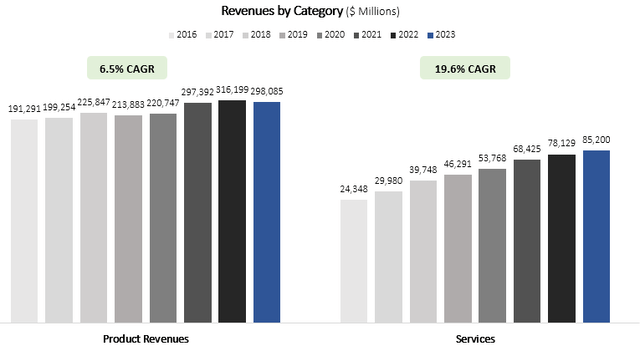

Created and calculated by the author based on data from Apple financial reports and earning calls.

As we can see, product revenue per active device was $135 in 2023, a significant decline from 2021 and 2022, as each of the company’s product categories experienced a decline.

Despite that, analysts, including myself, assumed that another uptick in sales is just a matter of time, anticipating an improvement when the macro backdrop improves and the typical 3-year cycle materializes.

However, as 2024 started, investors started questioning Apple’s ability to keep up with the generative AI boom.

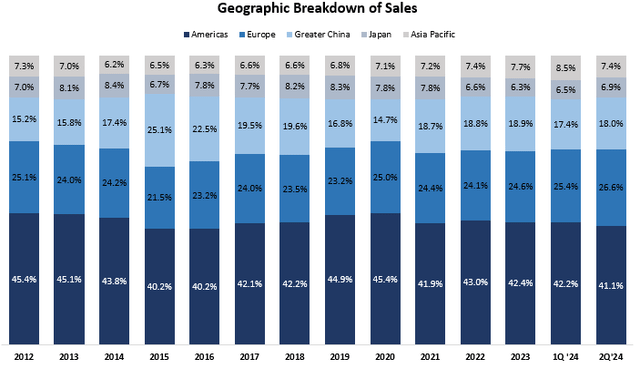

Created by the author based on data from Apple financial reports.

Moreover, a slew of bad news from China, which was responsible for ~19% of the company’s sales in 2023, increased the worries about Apple’s ability to accelerate growth.

Created and calculated by the author using data from Apple financial reports.

The one category that’s been an outlier is Services, where Apple maintained a 19.6% sales CAGR and a mid-teens growth pace over the last three quarters. However, the company is experiencing elevated regulatory scrutiny over its App Store fees and policy, especially in the EU, and so is its relationship with Google, which is the largest contributor to Services revenue.

This has made investors worried that even the “good part” of the company would start showing weakness. Not only that, the company had a bad second quarter, where it surpassed EPS estimates only due to accelerated buybacks, and revenues came slightly above consensus estimates pre-announcement, but much lower than where estimates were a few months ago.

All these worries have culminated in Warren Buffett’s selling of shares, which might not be a big deal, but it’s certainly not a positive driver for the stock.

Overcoming The Worries Through GenAI Buzz & Historic Buyback Announcement

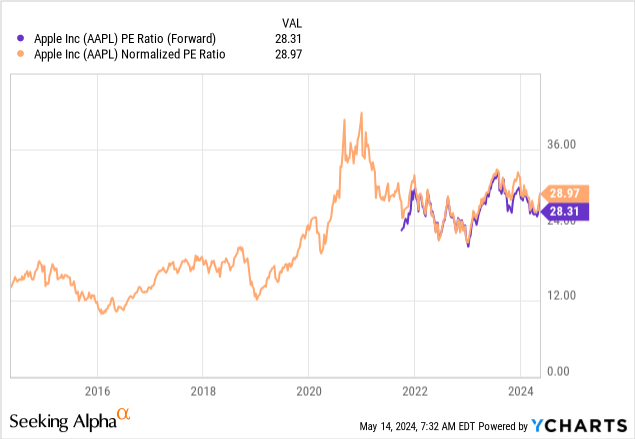

Nothing that we discussed so far should have resulted in shares being flat year-to-date. Not only that, Apple has maintained a historically high multiple for the company in the high-twenties.

So what’s the explanation? Well, Apple announced a $110 billion buyback last quarter, but in reality, this pace of share repurchases isn’t that big of a surprise from Apple, which already had a $90 billion and a $100 billion authorizations, and has had six consecutive years with buybacks of $70 billion or higher.

I think almost the entirety of the recovery can be attributed to investors’ excitement heading into Apple’s WWDC. With so many reports about different kinds of new GenAI features, and management referring to the event as one of the company’s most innovative in history, it’s reasonable that investors want to “buy the rumor”.

The question is, will they want to sell the news?

What To Expect In The Upcoming WWDC

Before we get into the new GenAI features, a rumored OpenAI collaboration, and Apple’s own AI chips, I think we should look at the bigger picture.

For Apple’s shares to work, investors need to see revenue growth. I estimate that Apple can trade as high as a 30x multiple if it demonstrates a clear path to mid-to-high single-digit revenue growth over the next several years.

How will such a path look? Well, it will primarily rely on a strong iPhone release. The last strong iPhone was the iPhone 12, released in November 2020. In FY21, Apple had $192 billion in iPhone sales, and the pandemic-fueled sales continued into FY22 when the company had $205 billion in iPhone sales.

Created and calculated by the author using data from Apple financial reports.

Being more than three years away from the last strong release positions Apple pretty well ahead of the iPhone 16, and that’s even without the GenAI contribution.

So, a potential OpenAI partnership, an improved Siri, and other exciting AI features in photo editing, writing, music, and more, should be more than enough to create a strong iPhone 16 cycle.

With that said, several questions need to be asked.

First, is this more of a popular theme in the financial community, while the majority of Apple customers don’t really have a need to upgrade their phones?

Second, how much of this would be structural growth? Or is it the new reality for Apple shareholders, a strong iPhone cycle once every three or four years, and lackluster growth in between, resulting in market-average growth over time at best?

Valuation & Near-Term Investment Strategy

Apple’s fiscal year isn’t aligned with the calendar year. I’ll use calendar year numbers for a more convenient comparative analysis.

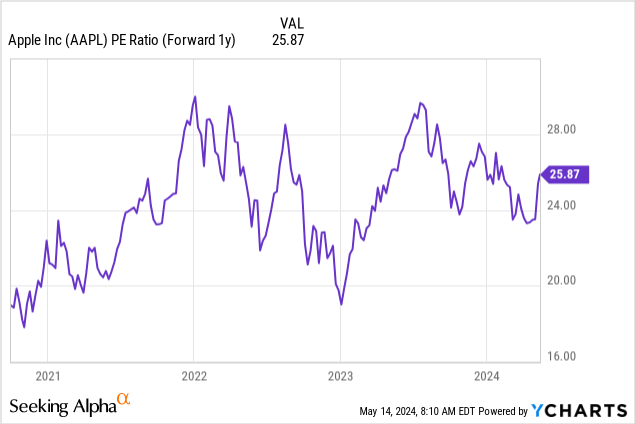

Based on current consensus estimates, Apple’s ’24 EPS is expected to be $6.70, up 3.7% Y/Y, and reflecting a 28x multiple. In calendar ’25, EPS estimates stand at $7.39, reflecting 10.5% growth and a 25x P/E. Revenue growth should be 1.5%, and 6.2%, respectively.

In my view, Apple’s valuation range is 23x-30x, considering the current S&P 500 P/E is at 20.7x. The low end reflects low-single-digit (1%-3%) growth, and the high end reflects high-single-digit growth (7%-9%).

Over the next decade, I believe the most reasonable expectation is that Apple will be in the middle, with 4%-6% growth. As such, I estimate a fair multiple for Apple will be in the 26x-28x range.

Right now, there’s a lot of excitement about GenAI, which is enough to overcome the declining revenues and sustain a 28x multiple. However, this won’t stick over time, and I expect that anything less than a very exciting WWDC will result in a decline.

When I look ahead to Apple’s next fiscal year, we can see the stock is only slightly below our fair multiple range.

So, here’s the bottom line. As I wrote in my previous article, I found the risk/reward ahead of the WWDC favorable when Apple was trading in the 25x range over 2024 earnings.

At current levels, Apple is a Hold. Only in the event of a perfectly executed conference and very exciting announcements, the stock won’t experience a sell-the-news decline. Then, investors will again focus on the company’s actual results, which aren’t expected to be good in the near term.

In my view, Apple sounded very excited about not-so-exciting announcements in the past (look no further than the recent iPad day), and I do think there’s a chance this WWDC will be a letdown, especially as key aspects like an OpenAI partnership won’t have enough time to come to fruition.

Conclusion

Apple’s future-defining WWDC is set to take place in less than a month, and investors are extremely excited.

This excitement is clearly reflected in the stock price, as Apple is now trading at a historically high multiple despite declining revenues and a long list of issues.

We’ve seen Apple’s management generate high expectations heading into lackluster announcements, and I’m worried this year’s WWDC might be another one of those sell-the-news situations.

In the long term, Apple’s path to above-market revenue growth remains unclear, even if the next iPhone cycle becomes a big success.

I find the stock slightly overvalued and reiterate Apple as a Hold.